Originally published by Midlands Innovation

The Universities as Drivers of Trade and Investment Pilot has been exploring how universities can help play more of an active role in securing Foreign Direct Investment into research and development. Metro-Dynamics is one of the project partners on this ambitious programme. In this blog Fiona Tuck and James Thompson explore an approach to help institutions identify and communicate investment assets.

It has long been acknowledged that the Creative Industries and Higher Education are two of the UK’s export success stories, but the export relationship between the two is less well understood. Even less frequently has there been investigation of how the two work together to drive inward investment into places.[1] However, our recent work with Midlands Innovation had a look as this very subject.

Midlands Innovation has recently delivered ‘Universities as Drivers of Trade and Investment Pilot’ exploring how Universities in the Midlands can leverage their global connections and place-based assets, to play an active role in securing inward investment into R&D. We worked with them to develop a simple, consistent and effective guide for universities to identify and articulate major R&D inward investment propositions, shown below.

Figure 1. Assets to be collectively considered in proposition development

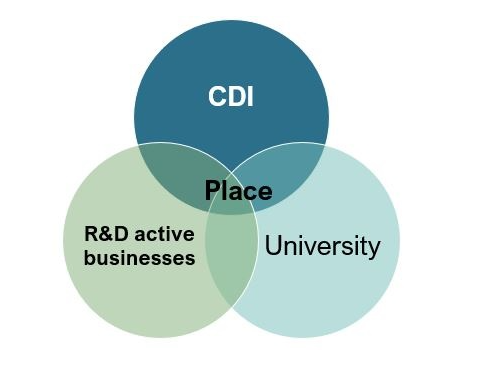

Initially looking at strong place-based propositions in Agri-Food, Zero-Carbon Energy, Transport Technology, and Health & Life Science sectors, via funding from AHRC the Pilot was expanded earlier this year to consider the Creative & Digital Industries and, specifically, identify places at the nexus of the main actors: Universities, R&D active businesses and Creative & Digital industries.

Figure 2. Identifying convergence of CDIs, R&D active businesses & Universities

You can read the full report here. In this article we highlight three core findings:

1. The Midlands is home to a rich industrial fusion of creative and digital industries, emerging technologies, and traditional, industrial heritage.

The Midlands is internationally renowned for its industrial heritage, from glass, iron and coal production in the Black Country, silk and textiles manufacturing in Derbyshire, to the inception of the first British car in Coventry. However, less recognised is its history of creativity which has long been embedded in the region. The Midlands has not only been the birthplace of many famous literary figures and musicians, but its creative institutions and businesses have been influential in shaping and developing its industry; key examples of this include the founding of Odeon Cinema in 1930, the hobby leader Games Workshop, through to the launch of Codemasters, the pioneering gaming developers, in 1986.

Over time these have become integrated together and today, the Midlands has a unique strength where heritage industries, industry 4.0 and creative services are deeply intertwined.

Recent studies have found that creative industries can be a force for innovation in the wider economy, generating spillover benefits where the ideas, innovations and processes created by Creative & Digital industries are transferred to firms in other industries, resulting in new innovative practices and improved outputs. This positive dynamic is particularly strong in the Midlands; for example, JLR utilising computer game technology to develop the future of the automotive sector, NHS hospitals in Birmingham are trailing the use of virtual reality to improve user experience, and fashion companies in Leicester are capitalising on the power of digital platforms.

2. There are many opportunities for inward investment in the Midlands. However, our findings, supported by quantitative insights from Data City, point to three key local clusters: Media & Film in Birmingham, Gaming in Leamington Spa, and Immersive Technology, Content & Experience design in Nottingham.

Of course, these are not the only opportunities in the Midlands; there are several other dynamic Creative & Digital Industries in the region, including fashion and design, arts, crafts and pottery, and software and publishing. However, for the purposes of the pilot – these currently have a strong convergence of – R&D active businesses, university presence and CDIs.

Media & Film in Birmingham

Media & Film is a high growth industry, with total national expenditure increasing from £3.4 billion in 2017 to over £5.64 billion in 2021, driven largely by inward investment and the rise of high-quality productions made for streaming platforms. Birmingham will play a critical role in driving growth within the sector nationally; investments into the BBC’s new regional office, the Tea Factory and the new Digbeth Loc production studios, combined with the high specialisation of motion picture employment demonstrate clear assets to build the cluster. A strong institutional environment is developing around the sectoral cluster in the city, with Create Central, the British Film Institute, and Film Birmingham supporting and promoting Birmingham based Media & Film business, as well as feeding into WMCA’s priorities within their regional ‘Plan for Growth’. The role of Universities within the local cluster is still emerging, but the high influx of students to Media & Film courses in the city provides a strong basis for Universities to further nurture creative talent.

Gaming in Leamington Spa

In Leamington Spa, the Midlands has one of the largest gaming clusters in the UK. This cluster has grown considerably since the 1980s and is now home to approximately 2,500 employees, over 80 gaming companies, and represents 10% of the entire UK gaming industry. Since beginning with Codemasters, the cluster has attracted several large multinational firms including SEGA and Ubisoft, and an ever-present independent gaming scene. Universities are unequivocally important in sustaining the growth of the cluster and enabling further inward investment; facilities such as Coventry University’s Disruptive Media Learning Lab, provide businesses with the capability to develop, test and adopt new technologies and ideas, some of which will go on to attract the attention of international leaders in gaming and digital entertainment. There is also a role of Universities around Leamington Spa to lean into their relationships and expertise in advanced manufacturing, particularly in automotive, to maximise the opportunities for industrial fusion with the innovative gaming cluster.

[1] Whilst significant work has been done to geographically map, evaluate and categorise Creative & Digital clusters, notably by NESTA, PEC and Frontier Economics, there is a ‘missing evidence base’ around where in the Midlands inward investment is happening, which consequently means there is knowledge gap around what role universities should play in investment propositions. Interesting reads include: UK International Student Statistics, Creative Economy Outlook, The geography of creativity in the UK, Creative Nation, Creative radar, Understanding the growth potential of creative clusters, The nature of foreign direct investment in the creative industries

Immersive technology, content & experience design in Nottingham

Immersive technology involves using new ways to create, display or interact with applications, content and experiences by merging the physical world with simulated reality. It is often associated with the use of a specific technology, like Augmented or Virtual Reality (AR and VR) but also includes 3-D, spatial sensing and interactive experiences. Immersive technologies and their application are the future of design, modelling, prototyping, training, storytelling, services gamification and retail diversification, and are therefore critical for the national economy’s competitiveness going forward. In the Midlands, Nottingham sits at the heart of this opportunity, with strong assets for each components of the place-anchored ‘Venn’. The universities in Nottingham have put considerable investment into dedicated facilities, such as Mixed Reality labs, Virtual Immersive Production Studio and the Confetti Institute of Creative Technologies; these facilities, alongside accompanying SME support programmes provide the necessary support for the area’s specialised cluster of creative talent. Local universities has positively influenced the creation of a stable Creative & Digital ecosystem, which have enabled growth in creative employment above other major cities including London; this strong ecosystem means there is a ripe environment to attract inward investment.

3. In this sector, Universities aren’t often the target for investors, who are most likely looking to acquire CDI businesses. But, they do play a critical role in enabling the development that makes those CDI businesses attractive to investors.

Figure 3. Nurturing role of Universities in the Creative & Digital Industries

In the other Pilot sectors, which are primarily centred around technological innovation translated to physical products, it is common to see inward investment flow to Universities directly into spin-outs, research or through taking up residencies on campus or at science parks.

However, investors in the Creative & Digital industries are less likely to operate in this way; rather investment is more likely to be about acquiring creative IP to absorb into their creative portfolio – and most frequently this means buying up smaller independent firms, rather than spending on a University led R&D project.

That Universities aren’t the primary target, doesn’t mean they don’t factor into strong investment propositions, in fact it’s quite the opposite – Universities are critical place-based anchors which enable R&D active Creative & Digital businesses.

Backseat, or frontseat – they are a driver, not a passenger.